{“web page”:0,”12 months”:2024,”monthnum”:1,”day”:26,”identify”:”sp-djis-global-islamic-equity-benchmarks-surged-nearly-12-in-the-final-quarter-outperforming-conventional-benchmarks-in-2023″,”error”:””,”m”:””,”p”:0,”post_parent”:””,”subpost”:””,”subpost_id”:””,”attachment”:””,”attachment_id”:0,”pagename”:””,”page_id”:0,”2nd”:””,”minute”:””,”hour”:””,”w”:0,”category_name”:””,”tag”:””,”cat”:””,”tag_id”:””,”writer”:””,”author_name”:””,”feed”:””,”tb”:””,”paged”:0,”meta_key”:””,”meta_value”:””,”preview”:””,”s”:””,”sentence”:””,”identify”:””,”fields”:””,”menu_order”:””,”embed”:””,”category__in”:[],”category__not_in”:[],”category__and”:[],”post__in”:[],”post__not_in”:[],”post_name__in”:[],”tag__in”:[],”tag__not_in”:[],”tag__and”:[],”tag_slug__in”:[],”tag_slug__and”:[],”post_parent__in”:[],”post_parent__not_in”:[],”author__in”:[],”author__not_in”:[],”search_columns”:[],”ignore_sticky_posts”:false,”suppress_filters”:false,”cache_results”:true,”update_post_term_cache”:true,”update_menu_item_cache”:false,”lazy_load_term_meta”:true,”update_post_meta_cache”:true,”post_type”:””,”posts_per_page”:”5″,”nopaging”:false,”comments_per_page”:”50″,”no_found_rows”:false,”order”:”DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities, Real & Digital Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”George Valantasis”,”title”:”Associate Director, Factors and Dividends”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Andrew Innes”,”title”:”Head of Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Senior Analyst, Factors and Dividends”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Daniel Perrone”,”title”:”Former Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Narottama Bowden”,”title”:”Director, Sustainability Indices Product Management”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”},{“display”:”Elizabeth Bebb”,”title”:”Director, Factor & Dividend Indices”,”image”:”/wp-content/authors/elizabeth_bebb-511.jpg”,”url”:”https://www.indexologyblog.com/author/elizabeth_bebb/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”}]

S&P DJIâs International Islamic Fairness Benchmarks Surged Just about 12% within the Ultimate Quarter, Outperforming Standard Benchmarks in 2023

International equities witnessed a powerful This fall 2023 as slowing inflation and the opportunity of decrease rates of interest progressed marketplace sentiment tremendously. The S&P International BMI rallied 11.4% for the quarter, completing the 12 months with an outstanding 21.9% go back. Heart East and North Africa (MENA) equities rose 6.4% in This fall, as measured via the S&P Pan Arab Composite, including to a ten.1% general go back for the 12 months. Gulf Cooperation Council (GCC) nations in large part posted features, led via Bahrain (23.4%) and Saudi Arabia (15.0%), whilst Kuwait was once an exception, with a 6.3% loss.

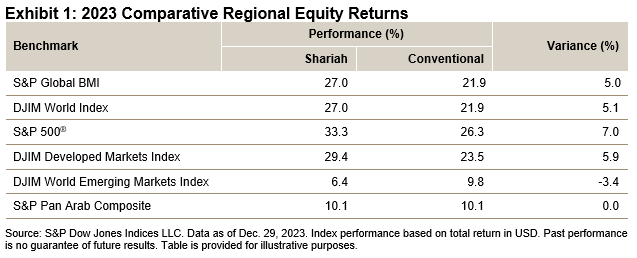

Shariah-compliant benchmarks, together with the S&P International BMI Shariah and Dow Jones Islamic Marketplace (DJIM) Global Index, beat their traditional opposite numbers via about 0.5% throughout the quarter, extending their outperformance to over 5% for the 12 months and 19.7% cumulative during the last 5 years. In large part pushed via its outperformance within the U.S., the benchmark DJIM Evolved Markets Index stood out for relative efficiency towards the traditional benchmark in 2023. The DJIM Global Rising Markets Index was once a laggard, trailing in the back of the traditional benchmark in addition to the advanced marketplace counterpart (see Show off 1).

Drivers of Shariah Index Efficiency in 2023

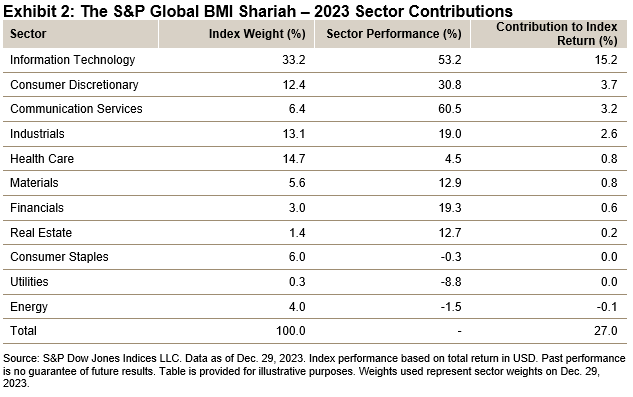

The outperformance of Shariah benchmarks towards their traditional opposite numbers steadily comes into center of attention in the course of the lens of sectors. Throughout world inventory markets total, a better publicity to Data Era shares inside of Islamic indices, no publicity to standard Financials (together with banks) and not more publicity to extremely indebted corporations (similar to utilities) had been the key drivers of the efficiency variance ultimate 12 months.

The Data Era sectorâs 53% achieve performed a significant section in 2023, contributing to greater than part of the S&P International BMI Shariahâs general go back. Power, Utilities and Client Staples had been the one sectors with losses for the 12 months, whilst their affect was once restricted given their small illustration within the index (see Show off 2).Â

International Sukuk Became Round in This fall 2023

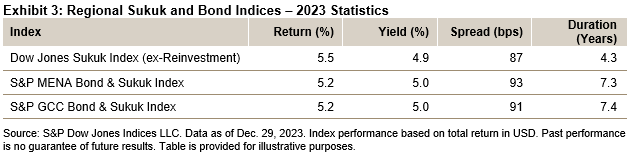

The worldwide sukuk marketplace additionally had a forged quarter with a achieve of four.5%, as measured via the Dow Jones Sukuk Index (ex-Reinvestment). The benchmark ended the 12 months with a 5.5% go back, falling quite wanting the 5.7% annual go back of the iBoxx USD Total, an international USD-denominated funding grade bond benchmark. The regional MENA and GCC Bond & Sukuk benchmarks received 5.2%.

This newsletter was once first printed in IFN Quantity 21 Factor 3 dated Jan. 17, 2024.

The posts in this weblog are critiques, now not recommendation. Please learn our Disclaimers.

Monetary Making plans The usage of Indices: From Taxes to Components

How are advisors placing SPIVA information and elements to paintings as they construct long-term plans to assist shoppers reach targets? Delta Wealth Advisorsâ Dino Efthimiou and Niko Finnigan sign up for S&P DJIâs Brent Kopp for a realistic have a look at the significance of tax control and the function of indexing in development a complete plan for shoppers.

Â

Â

The posts in this weblog are critiques, now not recommendation. Please learn our Disclaimers.

2023 Marketplace Assessment for Asian Buyers

There are doable diversification advantages for Asian traders who incorporate U.S. equities to relieve their tendency for a house nation bias. Representing almost 60% of the worldwide fairness marketplace, as measured via the S&P International BMI, U.S. equities supply a bigger alternative set outdoor of Asia, in conjunction with doable diversification because of other financial buildings and cycles between markets, coupled with differing sector exposures. The S&P 500®, extensively considered the finest unmarried benchmark of large-cap U.S. equities, has an estimated USD 5.7 trillion in belongings monitoring1 the index and a tough buying and selling ecosystem. Marketplace contributors can imagine the use of S&P 500 index-linked merchandise to successfully commerce U.S. equities.

2023 demonstrates the affect of U.S. fairness publicity for Asian traders. A slower-than-expected financial restoration in China with a persisted belongings marketplace downturn and ongoing U.S.-China tensions weighed on marketplace sentiment and function, making China and Hong Kong a few of the relative underperformers with their S&P BMI marketplace indices shedding 10% and 15%, respectively (see Show off 1). Then again, fairness markets remained resilient in different portions of the sector that had more potent financial backdrops. Easing inflation and the opportunity of decrease rates of interest resulted in a pointy marketplace rally within the fourth quarter, with the S&P International BMI ultimate the 12 months with a forged 22% general go back in USD. The U.S. was once a standout performer, with the S&P 500 posting a 26% general go back in 2023, greater than offsetting its lack of 18% in 2022.

Reversals had been additionally noticed at a sector degree. Data Era was once the best-performing sector, with an outstanding 58% achieve in 2023 following a 28% loss in 2022; the field contributed over 50% of the S&P 500âs go back in 2023. Communique Services and products and Client Discretionary additionally posted sturdy features of 56% and 42%, respectively, after steep losses of 40% and 37% in 2022, respectively. Utilities and Power had been the one sectors that closed the 12 months within the pink after certain returns in 2022 (see Show off 2).

At a inventory degree, the contribution to the marketplace go back from a couple of make a selection shares was once strangely top in 2023. The so-called âMagnificent Seven,â particularly Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla, surged 112% on reasonable over the 12 months, contributing 58% of the S&P 500âs go back. Nvidia was once the finest performer amongst them, with a 239% achieve, and changed into the 4th-largest inventory within the index (up from the tenth place to start with of the 12 months). This rally in mega caps resulted within the greatest underperformance of the S&P 500 Equivalent Weight Index2 as opposed to the S&P 500 (-12%) for the reason that equal-weight indexâs inception in 2003 (see Show off 3). With the Magnificent Seven emerging 4% on reasonable as opposed to the S&P 500âs 1% (as of Jan. 19, 2024), the relative efficiency of mega caps is still noticed as we input 2024.

1 Knowledge as of Dec. 31, 2022, according to S&P Dow Jones Indicesâ Annual Survey of Listed Belongings.

2 The S&P 500 Equivalent Weight Index (EWI) is the equal-weight model of the S&P 500. The index contains the similar constituents because the capitalization-weighted S&P 500, however every corporate within the S&P 500 EWI is allotted a hard and fast weightâor 0.2% of the index general at every quarterly rebalance. See right here extra details about this index.

The posts in this weblog are critiques, now not recommendation. Please learn our Disclaimers.

Inspecting Money Go with the flow in Small-Cap U.S. Equities

How does screening the S&P 600 for the highest 100 corporations according to loose money glide yield affect efficiency? S&P DJIâs Michael Mell takes a customized have a look at the Pacer US Small Cap Money Cows Index with Sean OâHara, President of Pacer ETFs and Cameron Dawson, Leader Funding Officer at NewEdge Wealth.

The posts in this weblog are critiques, now not recommendation. Please learn our Disclaimers.

The Relative Worth of Insights

Many traders use the beginning of the 12 months to make predictions for the approaching 12 months and to take into consideration techniques to precise perspectives on those topics. This endeavor isn’t assured so as to add price: predicting the long run is extremely tricky and good fortune calls for as it should be predicting each the drivers of long run efficiency and the approaching affect of various marketplace segments. The numerous imaginable eventualities imply this is it simple to be wrong-footed.

However, the inherent problem of forecasting signifies that traders might want to center of attention their consideration on marketplace segments the place there may be better praise for right kind perception. Dispersion supplies an preliminary overview of the possible praise for such perception. The better the dispersion, the better the possible rewards for as it should be choosing the best-performing constituents in that marketplace.

Show off 1 displays reasonable per thirty days dispersion figures for quite a lot of segments over the 15-year length finishing December 2023. The dispersion figures are calculated for various ranges of granularity, together with shares, sectors, nations, U.S. kinds and U.S. dimension segments. S&P SmallCap 600® inventory dispersion was once the best possible, on reasonable, greater than 3 times upper than the common dispersion amongst S&P 500® sectors. Decrease ranges of dispersion had been noticed between U.S. dimension or taste segments, or between nations or sectors within the S&P Evolved Ex.-U.S. BMI.

So does this imply that traders could be smartly served to center of attention their consideration on analysis into small-cap U.S. equities as an alternative of different spaces? Now not essentially: the relative price of perception additionally relies on the possible dimension of the positions that traders could possibly soak up other segments.

An investorâs skill to take lively positions is said to the common marketplace capitalization of constituents. For instance, there may be extra means to take an lively place in a trillion-dollar constituent in comparison to a smaller constituent. Show off 2 plots the common dispersion figures from Show off 1 towards the index-weighted reasonable constituent dimension of the other segments over the similar 15-year length (word the log scale at the y axis).

Obviously, there was a trade-off between dispersion and the common constituent dimension. Upper dispersion segments, which give better anticipated praise for right kind perception, might require smaller positions in comparison to decrease dispersion segments with greater constituents.

Capability-Adjusted Dispersion supplies a strategy to account for means when bearing in mind the possible price of perception. It’s calculated via multiplying the possible praise to right kind alternatives (dispersion) and doable dimension of lively positions (reasonable constituent dimension). Show off 3 displays the common ratio of capacity-adjusted dispersion measures for various segments in comparison to that of S&P 500 shares, according to per thirty days information over the 15-year length finishing December 2023.

Assuming that an investorâs predictions are in a similar fashion precious throughout every phase, Show off 3 means that settling on a few of the S&P Composite 1500® dimension segmentsâthe S&P 500, S&P MidCap 400®, and S&P SmallCap 600âmight be offering greater than 9 occasions the possible alternative in comparison to choosing S&P 500 shares. In a similar fashion, opting for between the S&P 500 Enlargement and S&P 500 Worth or settling on amongst S&P 500 sectors will have equipped identical alternatives as choosing nation parts of the S&P Rising BMI or S&P Evolved Ex-U.S. BMI.

Such is the adaptation in reasonable constituent dimension that insights into S&P SmallCap 600 shares would must be 50 occasions extra precious than insights into S&P 500 shares to give you the similar capacity-adjusted alternative.

In consequence, expressing perspectives thru a U.S. dimension, taste and sector lens may just provide identical alternatives as the use of a rustic lens. The relative means of those segments approach they are going to be offering better alternatives than many different segments.

Â

The posts in this weblog are critiques, now not recommendation. Please learn our Disclaimers.