Stock financiers have actually left to a unsteady start to the brand-new year, hobbled by moving expectations on the timing and degree of Federal Reserve interest-rate cuts in 2024.

All 3 significant U.S. stock indexes snapped a nine-week winning streak on Friday, after suddenly strong December task gains triggered traders to briefly draw back on the possibilities of a March rate cut. The S&P 500

SPX

and Nasdaq Composite.

COMPENSATION

likewise stopped working to stage a Santa Claus Rally from the 5 last trading days of 2023 through the very first 2 sessions of 2024, as concerns grew about the marketplace’s several rate-cuts view.

Everything amounts to a look of what may be in shop for financiers in the year ahead. Currently, the so-called “January impact,” or theory that stocks tend to increase by more now than any other month, might be tested by headwinds that consist of stalling development on inflation. Inflation’s down pattern in current months had actually provided traders and financiers hope that as lots of as 6 or 7 quarter-percentage-point rate cuts from the Federal Reserve might be provided in 2024, beginning in March.

Over the very first handful of days in the brand-new year, nevertheless, truth has actually begun to sink in. For something, several rate cuts tend to be more frequently related to economic crises and not soft landings for the economy.

Furthermore, the concept that the Fed might follow through with as lots of rate cuts as pictured by traders would considerably increase the possibility that policymakers lose their fight versus inflation, according to Mike Sanders, head of set earnings at Wisconsin-based Madison Investments, which handles $23 billion in properties. That’s since 6 or more rate cuts would loosen up monetary conditions by excessive, and increase the threat of another bout of inflation that requires authorities to trek once again, he stated.

Minutes of the Fed’s Dec. 12-13 conference reveal that policymakers doubted about their projections for rate cuts this year and stopped working to dismiss the possibility of more rate walkings. Nevertheless, fed funds futures traders continued to hold on to expectations for a huge decrease in loaning expenses, with the best possibility now coalescing around 5 or 6 quarter-point rate cuts that amount to 125 or 150 basis points of reducing by year-end. That’s approximately two times as much as what policymakers booked last month, when they voted to keep rate of interest at a 22-year high of 5.25% to 5.5%.

Source: CME FedWatch Tool, since Jan. 5.

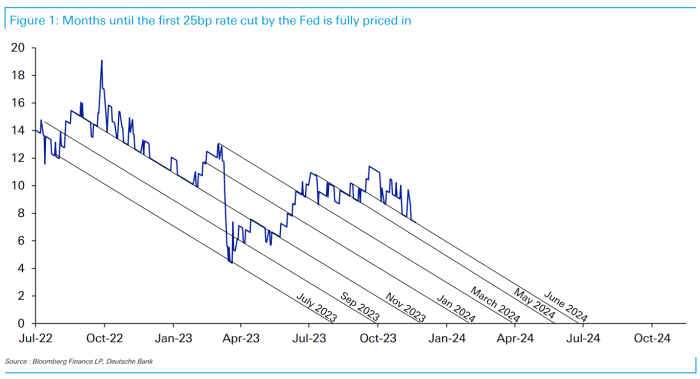

Unpredictability over the course of U.S. rate of interest might leave financiers flat-footed as soon as again, and damp the optimism that sent out all 3 significant stock indexes in 2023 to their finest yearly efficiencies of the previous 2 to 3 years. In November, experts at Deutsche Bank AG.

DB,.

counted 7 times because 2021 in which markets anticipated the Fed to make a dovish pivot, just to be incorrect.

Sources: Bloomberg, Deutsche Bank. Chart is since Nov. 20, 2023.

Monetary markets have actually been running with “sky-high expectations” for 2024 rate cuts, however the only method to validate 6 cuts this year is with an “abrupt and sharp slump in the economy,” stated Todd Thompson, handling director and portfolio co-manager at Reams Property Management in Indianapolis, which manages $27 billion.

Heading into 2024, ecstasy over the possibility of lower loaning expenses produced what Thompson calls “a disconcerting, whatever rally,” which he states leaves equities and high-yield business financial obligation susceptible to pullbacks in between now and the next 6 months. Beyond that duration, nevertheless, “the pattern is most likely to be lower rates as the economy lastly catches tightening up conditions at the exact same time inflation continues to decline.”

The coming week brings the next significant U.S. inflation upgrade, with December’s customer rate index report launched on Thursday. The yearly heading rate of inflation from CPI has actually slowed to 3.1% in November from a peak of 9.1% in June 2022. In addition, the core rate from the Fed’s preferred inflation gauge, referred to as the PCE, has actually reduced to 3.2% year-on-year in November from a 4.2% yearly rate in July.

The Fed requires to keep rate of interest greater since of all the unpredictability around inflation’s more than likely course forward, and the U.S. labor market “will not deteriorate quickly enough in the very first quarter to validate a very first rate cut in March,” according to Sanders of Madison Investments.

Rate-cut expectations are “going to be the concern for 2024, and a great deal of it is going to be focusing on inflation returning to that 2% target,” Sanders stated by means of phone. “We believe someplace in between 75 and 125 basis points of rate cuts make good sense, which the very first relocation is more of a June-type of occasion. We do not believe it makes good sense to have a March rate cut unless the labor market falls off a cliff.”

History reveals that Treasury yields tend to fall in the months leading up to the very first rate cut of a Fed reducing cycle. Nevertheless, that isn’t occurring today. Yields on federal government financial obligation have actually been on an upward pattern because completion of December, with 2-.

BX: TMUBMUSD02Y,

10-.

BX: TMUBMUSD10Y,

and 30-year yields.

BX: TMUBMUSD30Y

ending Friday at their greatest levels in more than 2 to 3 weeks.

See likewise: What history states about stocks and the bond market ahead of a very first Fed rate cut

While monetary markets normally tend to be effective processors of info, they “have not been extremely precise in regards to prices in rate cuts” this time, stated Lawrence Gillum, the Charlotte, North Carolina-based chief fixed-income strategist for broker-dealer for LPL Financial. He stated the huge threat for 2024 is if monetary conditions reduce excessive and the Fed states triumph on inflation prematurely, which might reignite rate pressures in a way similar to the 1970s duration under previous Fed Chairman Arthur Burns.

” We believe rate-cut expectations have actually gone too far too quickly, which the backup in yields we are seeing today is the marketplace acknowledging that perhaps rate cuts are not going to be as aggressive as what was priced in,” Gillum stated by means of phone.

December’s CPI report on Thursday is the information emphasize of the week ahead.

On Monday, consumer-credit information for November is set to be launched, followed the next day by trade-deficit figures for the exact same month.

Wednesday brings the wholesale-inventories report for November and remarks by New york city Fed President John Williams.

Preliminary weekly unemployed claims are launched on Thursday. On Friday, the manufacturer rate index for December comes out.

.