J. Michael Jones

Synovus Financial Corp. ( NYSE: SNV) runs as a bank holding business for Synovus Bank; it was established back in 1888 and is headquartered in Columbus, Georgia.

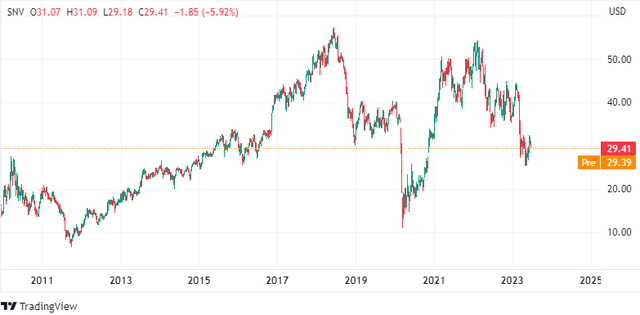

In spite of a minor healing in current weeks, the impacts of the banking crises set off by SVB’s insolvency are still being shown in the cost of Synovus Financial, which is absolutely far from its all-time high. Nevertheless, such a decrease has actually exposed chances that were not there prior to, consisting of a dividend yield of 4.80%.

As I will reveal you throughout this short article, at this cost Synovus Financial might be a great alternative, specifically for those searching for high and sustainable dividends. However it is most likely not for me.

Deposits Quality

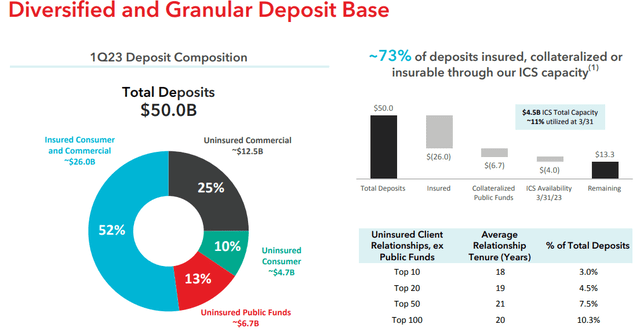

In my viewpoint, deposits quality is the very first element to think about when evaluating a bank, as it is the raw product on which the whole monetary structure is based. I will now reveal you how Synovus Financial is placed in this regard.

Synovus Financial Corp Q1 2023

First Off, about 73 percent of deposits are guaranteed, collateralized or insurable. The deposit base is both varied and not extremely focused, which is favorable. In reality, the leading 100 uninsured consumers represent simply over 10 percent of overall deposits.

Synovus Financial Corp Q1 2023

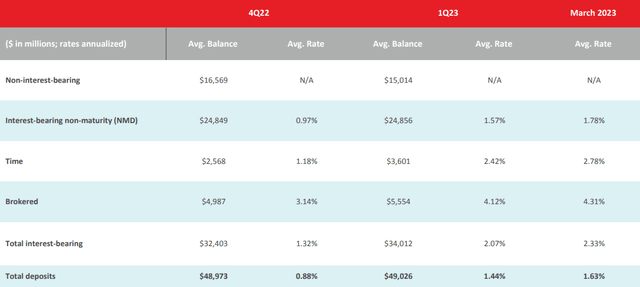

Most likely the least favorable element worries the expense of deposits, in reality in March 2023 the typical interest paid was 1.63% when just a couple of months previously it was 0.88%. In addition, it is likewise essential to point out that non-interest-bearing deposits have actually reduced by $1.55 billion compared to Q4 2022, which is absolutely an aspect to think about. Synovus Financial has actually needed to discover other methods to change these complimentary funds, consisting of time deposits and brokered CDs, both of which are considerably more pricey. Integrating both deposits and loans, the general typical expense totaled up to 2.33 percent in March, 101 basis points more than in Q4 2022.

Synovus Financial Corp Q1 2023

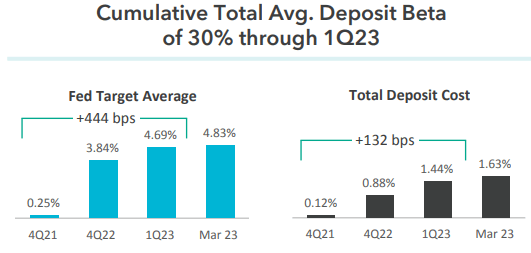

Comparing the boost in the Fed Funds Rate and the expense of deposits, Synovus Financial had the ability to accomplish a deposit beta of 30 percent, which is a good outcome however definitely not optimum. According to the current Fed approximates, we can anticipate a minimum of 2 more 25 basis point walkings by the end of the year, which might imply that the deposit beta might continue to increase.

Over the previous month I have actually been evaluating lots of local banks, and Synovus Financial reveals typical lead to regards to deposit expenses; absolutely nothing uneasy however absolutely nothing interesting either. For instance, there are banks like Banner that have actually not been impacted as much by the rates of interest boost; in reality, it still displays a deposit expense of less than 0.30 percent.

Making Property Structure and Net Interest Margin

The deposits expense is not the only aspect that changes for rate of interest; there is likewise the yield on possessions.

Synovus Financial Corp Q1 2023

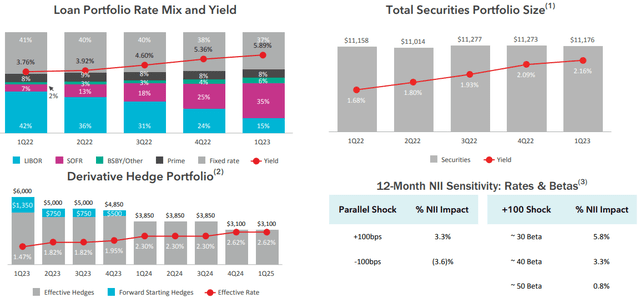

The loan portfolio rate slowly increased each quarter and reached 5.89 percent, that makes the boost in the expense of liabilities less bitter. At the exact same time, the securities portfolio likewise provided a development in yield, although its size stayed practically the same from Q1 2022.

Although not included in this slide, with regard to the securities portfolio it ought to be explained that, since Q1 2023, it is signing up a latent loss of as much as $1.28 billion, a considerably big figure. In reality, it represents about 27 percent of equity. Synovus Financial, along with lots of other banks, made significant purchases of fixed-rate securities prior to the Fed strongly raised rate of interest, and this resulted in a big latent loss, specifically for high period securities. If the Fed were to cut rate of interest a lot, the issue would decline: the point is that prior to 2024 it is not likely to occur. So, as long as the macroeconomic condition stays the exact same, we need to consider this big latent loss in Synovus Financial’s balance sheet. The latter, obviously likewise weighs on the Book Worth per share, an essential metric to which each bank’s cost per share follows.

Sticking with rates of interest threat, in the last slide we can see the anticipated modification in net interest earnings (NII) as rate of interest alter. A 100-basis point boost would have a +3.30 percent effect on NII; a 100-basis point reduction would have a – 3.60 percent effect. In other words, the bank is placed towards an additional boost in rate of interest. Hence, must the Fed minimize them, on the one hand the latent loss of the securities portfolio would be lowered, however on the other hand the NII would suffer.

Synovus Financial Corp Q1 2023

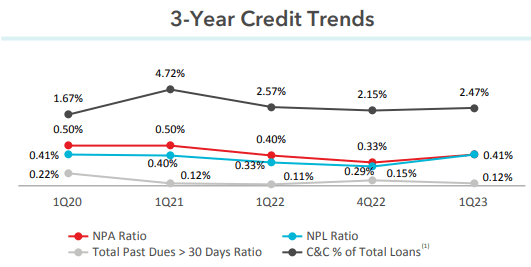

Returning briefly to the loan portfolio, we can see that at the minute the primary indices utilized for credit threat are all in excellent standing. So, in spite of Synovus Financial’s considerable direct exposure to the CRE sector, for the time being, there is no factor to question the credit reliability of its debtors.

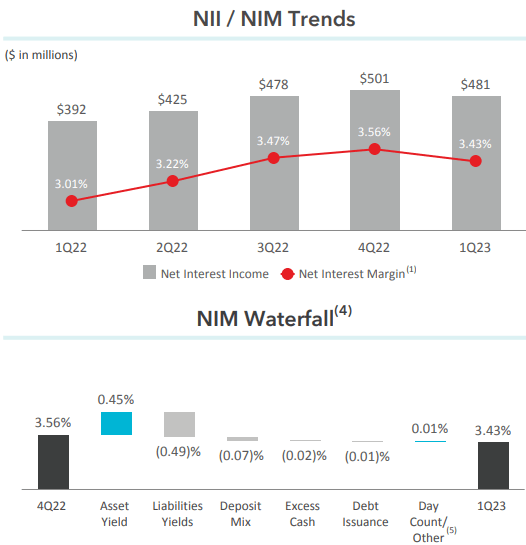

In any case, although the yield on possessions has actually enhanced, it has actually not had the ability to completely cover the boost in the expense of liabilities. In reality, the net interest margin reduced by 13 basis points compared to Q4 2022.

Synovus Financial Corp Q1 2023

Property yield impacted +0.45%, however it was inadequate versus – 0.49%. In addition, excess money and deposit mix likewise did not assist Synovus Financial; – 0.02% and – 0.07% respectively.

Dividend Analysis

As prepared for at the start of the short article, the dividend yield of Synovus Financial appears appealing for those who choose to buy business with a high dividend yield; in this case, we are discussing 4.80%. However is it sustainable?

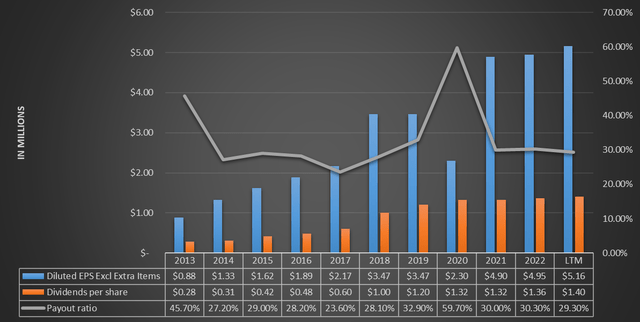

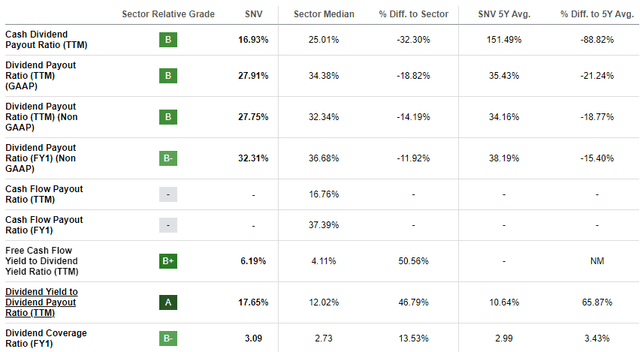

Comparing watered down EPS with dividend per share, it appears that the previous are considerably greater than the latter. In reality, the payment ratio is rather low, just 29.30 percent. So even if EPS decreases in the coming years due to the long-awaited economic downturn, in my viewpoint, management will continue to release a great dividend anyhow. After all, Synovus Financial has a dividend yield of 4.80 percent with a payment ratio of 29.30 percent; if EPS dropped even 20-30 percent, the payment ratio would still be less than half.

In other words, disallowing any marvelous unexpected occasions, I think about the dividend to be sustainable in the coming years.

Lastly, according to Looking for Alpha’s information on the dividend security, Synovus Financial’s ratios are typically much better than its peers. In other words, a minimum of for the minute the scenario is steady.

Assessment

To examine the reasonable worth of Synovus Financial, I will utilize a weighted average amongst 3 assessment techniques; the very first will weigh 40% and will be based upon book worth, the second will have the exact same weight however will be based upon EPS, and the 3rd will be a dividend discount rate design with a weight of 20%. All information will be acquired from Looking for Alpha.

- The typical price/book worth over the last 5 years is 1.31 x; increasing this figure by the present book worth per share of $28.98 lead to a reasonable worth of $37.96 per share.

- The typical P/E for the previous 5 years has actually been 10.82 x; increasing this figure by the anticipated EPS for 2023 of $4.73 ( Street price quotes), the reasonable worth total up to $51.17 per share.

- When it comes to the dividend discount rate design, the inputs will be as follows:

- Yearly Payment (FWD) of $1.52 per share.

- Yearly return needed from the financial investment 15%. We are discussing a little local bank, and being a really dangerous financial investment, in my viewpoint a high return is needed to take this threat.

- Dividend development of 8% annually. Over the previous ten years the CAGR has actually been 17.79%, nevertheless I wished to consist of a more conservative worth. After all, the macroeconomic environment has actually absolutely altered from ten years back.

The resulting reasonable worth following these presumptions is $23.45 per share.

Summing it up, the very first 2 techniques reveal that Synovus Financial is underestimated, specifically the one with profits, while for the dividend discount rate design this bank is misestimated. In the last approach, the needed return absolutely impacted a lot, however I believe it is inevitable provided the riskiness of the financial investment.

By making the weighted average of the 3 designs according to the instructions I pointed out previously, the reasonable worth of Synovus Financial is $40.34 per share, so the stock is underestimated.

Last Ideas

In General, Synovus Financial is a bank that has actually struggled with the increasing expense of deposits and this has actually impacted the net interest margin. Latent losses are another problem to keep track of, however I stay positive since when the Fed lowers rate of interest this loss will vanish. At the minute, the marketplace is marking down these concerns in the cost of Synovus Financial, which is why it appears rather at a discount rate. So, the stock is underestimated, the dividend is high, however why do not I buy it?

The factor is that like Synovus Financial, lots of other local banks remain in a comparable scenario, which leads me to prevent purchasing them. Instead of invest separately in all these banks with comparable attributes and issues, I choose to purchase an ETF. If I need to buy a single bank, I desire it to have peculiarities that run out the common. In this regard, I recommend you read my short article on Banner Corporation, a semi-unknown bank that I think might show the latter description.