Stock financiers are revealing some hesitancy for Tuesday, with huge signals on the economy coming today through customer rates and retail sales. Ahead of that, Apple is anticipated to lure customers with yet another brand-new iPhone on Tuesday.

Just how much should financiers be fretting today? Our call of the day from Pershing Square Capital Management supervisor Costs Ackman states that in the near term, we can unwind a little, however it isn’t all roses.

He informed the Julia La Roche Program in an interview where he seemed like he had a “crystal ball of what was going to occur,” beginning in January 2020 with the COVID-19 break out, which continued through rate of interest and the economy. Certainly, the supervisor apparently made almost $4 billion on a number of pandemic-related bets.

” I would state the crystal ball has actually clouded a bit in the last duration. I believe these are uncommon financial times and possibly we constantly state that, however I do not believe this is a pattern that has actually been duplicated … or it hasn’t been for more than 100 years,” he stated.

However he stays near-term upbeat. “For 2 years, individuals have actually been stating that economic downturn’s around the corner and you understand we have actually had an extremely various view, and continue to have this view that I believe individuals are happening to, that the economy is in fact still rather strong,” he stated.

And while those on lower-income rungs have actually burned through a great deal of COVID cost savings, he believes the economy has yet to truly see effect from the huge financial stimulus seen recently.

Looking down the roadway however, Ackman has actually got a stack of issues over the economy. He sees about a 3rd of federal financial obligation due to get repriced implying that over a reasonably brief amount of time, “interest expenditure will end up being a much larger part of the deficit that is not going to be a factor to the economy.”

And while greater rate of interest do assist savers, eventually that will be a huge drag on the economy, he stated, including that increasing inflation, home mortgage rates, automobile payments and charge card rates, are all set to slow the economy.

” We’re still in the middle of a war and there’s political unpredictability you understand with an approaching election,” he stated. That partially discusses Pershing Square’s hedge through a brief position on the 30-year Treasury bond

BX: TMUBMUSD30Y

that he set out in a tweet in early August.

For approximately a year, long-lasting Treasury yields have actually been trading listed below short-dated ones, which is called an inverted yield curve, a phenomenon that’s typically viewed as a precursor to economic downturn.

” I do not see inflation returning to 2% so rapidly, if at all, and if in truth we remain in a world of relentless 3% inflation, you understand it does not make good sense to have a 4.3%, 4.25% Treasury yield,” he stated.

Other dangers? Ackman stays concerned about local banks following the spring crisis, as numerous have huge fixed-rate portfolios of possessions that have actually gotten less and less important as rates increase. “I would state the industrial realty photo has actually not improved, if anything, you understand, you’re going to begin seeing genuine defaults, especially with workplace possessions,” he stated.

” Regional banks have the most direct exposure to building loans so they are going to be a great deal of building loans that will not have the ability to paid back. There will be a great deal of restructurings, so either the financiers groups are gon na need to put in a lot more equity or the banks are going to begin taking some losses,” he stated.

Ackman states financiers likewise deal with a governmental project that might include some tension. The hedge-fund supervisor stated he marvels there have actually not been “more and much better alternative prospects” for the 2024 project over President Joe Biden and previous President Donald Trump.

He wishes to see JPMorgan Chase & & Co. CEO Jamie Dimon toss his hat in the ring and thinks Biden is “beatable,” by a strong prospect.

Ackman himself stated it’s “possible,” he himself might run one day, however he’s more concentrated on having a much better financial investment performance history over Berkshire Hathaway Chairman and CEO Warren Buffett– and requires some thirty years to match the Oracle of Omaha.

Check Out: Here’s a simple method to make a more focused play on the ‘Stunning 7’ stocks

The marketplaces

Stock futures.

ES00,.

NQ00,.

are tilting south, led by tech, with Treasury yields.

BX: TMUBMUSD02Y

BX: TMUBMUSD10Y

constant to a touch lower and the dollar.

DXY

recuperating some ground.

For more market updates plus actionable trade concepts for stocks, alternatives and crypto, sign up for MarketDiem by Financier’s Organization Daily

The buzz

Oracle shares.

ORCL,.

are down 10% in premarket trading after frustrating assistance from the cloud database group.

Apple’s.

AAPL,.

huge occasion begins at 1 p.m. Eastern, with the launch of the costlier iPhone 15 anticipated to be on the program.

Hot ticket. Arm Holdings’ IPO is currently 10 times oversubscribed and lenders will stop taking orders by Tuesday afternoon, Bloomberg reports, pointing out sources.

Tech’s wild week: How Apple, Google, AI, Arm’s mega IPO might set the program for many years

Positive outcomes are increasing shares of convenience-store operator Casey’s General Stores.

CASY,.

Product packaging huge WestRock.

WRK,.

and competing Smurfit Kappa.

SK3,.

have actually revealed a stock and money bind. WestRock shares are up 8% in premarket.

Check Out: U.S. deficit spending will double this year to $2 trillion, leaving out trainee loans

Finest of the web

No much better than betting? Amateur financiers are stacking into 24-options.

China might prohibit clothing that harm individuals’s sensations.

U.S. handles tech huge Google in landmark case.

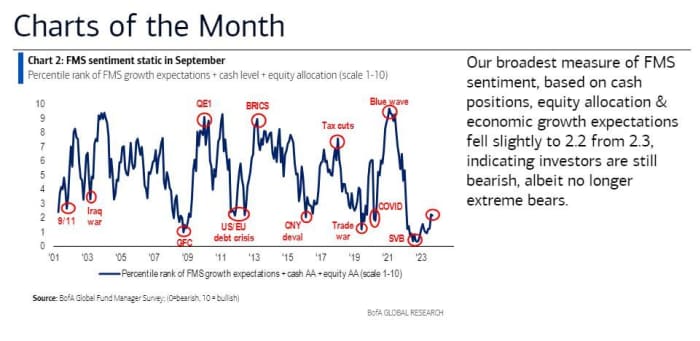

The chart

Bank of America’s international fund supervisor study for September sees financiers still bearish, however no longer on the severe side. Here’s the chart:

The tickers

These were the most active stock-market tickers on MarketWatch since 6 a.m. Eastern:

| Ticker. | Security name. |

|

TSLA,. |

Tesla. |

|

AMC,. |

AMC Home entertainment. |

|

CGC,. |

Canopy Development. |

|

NVDA,. |

Nvidia. |

|

GME,. |

GameStop. |

|

AAPL,. |

Apple. |

|

ACB,. |

Aurora Marijuana. |

|

NIO,. |

Nio. |

|

MULN,. |

Mullen Automotive. |

|

AMZN,. |

Amazon. |

Random checks out

” Worst financial investment ever.” Brady Lot fan purchases initial home for cut-price $3.2 million

Countless individuals “check out” this museum of 300 tanks every year

Required to Know begins early and is upgraded up until the opening bell, however register here to get it provided as soon as to your e-mail box. The emailed variation will be sent at about 7:30 a.m. Eastern.

Listen to the Finest Originalities in Cash podcast with MarketWatch monetary writer James Rogers and financial expert Stephanie Kelton.