{“page”:0,” year”:2024,” monthnum”:1,” day”:3,” name”:” twenty-first-century-fox-djci-gold-tops-stocks-and-bonds-this-century”,” mistake”:””,” m”:””,” p”:0,” post_parent”:””,” subpost”:””,” subpost_id”:””,” accessory”:””,” attachment_id”:0,” pagename”:””,” page_id”:0,” 2nd”:””,” minute”:””,” hour”:””,” w”:0,” category_name”:””,” tag”:””,” feline”:””,” tag_id”:””,” author”:””,” author_name”:””,” feed”:””,” tb”:””,” paged”:0,” meta_key”:””,” meta_value”:””,” sneak peek”:””,” s”:””,” sentence”:””,” title”:””,” fields”:””,” menu_order”:””,” embed”:””,” classification __ in”: [],” classification __ not_in”: [],” classification __ and”: [],” post __ in”: [],” post __ not_in”: [],” post_name __ in”: [],” tag __ in”: [],” tag __ not_in”: [],” tag __ and”: [],” tag_slug __ in”: [],” tag_slug __ and”: [],” post_parent __ in”: [],” post_parent __ not_in”: [],” author __ in”: [],” author __ not_in”: [],” search_columns”: [],” ignore_sticky_posts”: incorrect,” suppress_filters”: incorrect,” cache_results”: real,” update_post_term_cache”: real,” update_menu_item_cache”: incorrect,” lazy_load_term_meta”: real,” update_post_meta_cache”: real,” post_type”:””,” posts_per_page”:” 5″,” nopaging”: incorrect,” comments_per_page”:” 50″,” no_found_rows”: incorrect,” order”:” DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities, Real & Digital Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”George Valantasis”,”title”:”Associate Director, Factors and Dividends”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Andrew Innes”,”title”:”Head of Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Izzy Wang”,”title”:”Senior Analyst, Factors and Dividends”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Daniel Perrone”,”title”:”Former Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Elizabeth Bebb”,”title”:”Director, Factor & Dividend Indices”,”image”:”/wp-content/authors/elizabeth_bebb-511.jpg”,”url”:”https://www.indexologyblog.com/author/elizabeth_bebb/”},{“display”:”Narottama Bowden”,”title”:”Director, Sustainability Indices Product Management”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”}]

Twenty-First Century Fox: DJCI Gold Tops Stocks and Bonds This Century

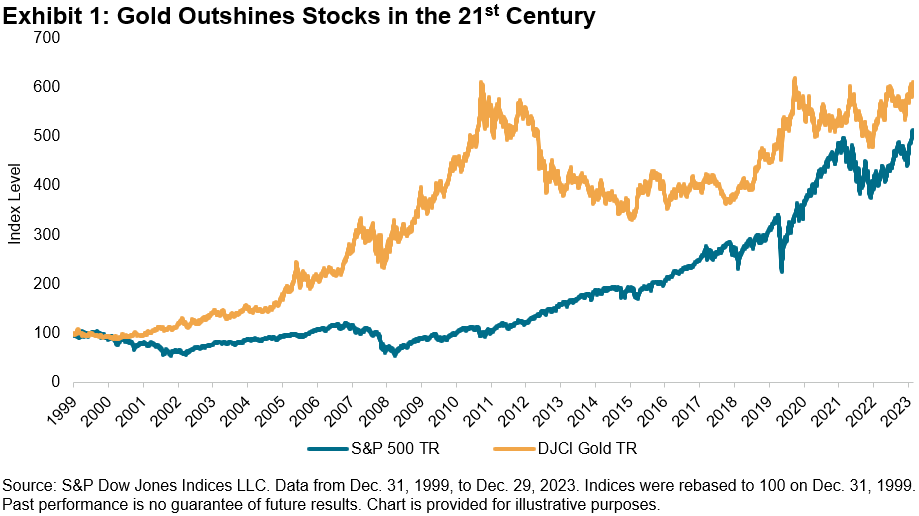

The equity markets roared to the goal, quickly passing products and bonds with a 26.3% return for the S&P 500 ®(* )in 2023. Much of that rally might be credited to decreasing customer cost indices and beneficial Federal Reserve assistance, with increased self-confidence in a soft landing. Decreasing inflation can best be observed at the cooking area table, where the S&P GSCI Grains saw 15% decreases on the year and the S&P GSCI Animals stayed flat. Regardless of another strong year of equity efficiency, the

Dow Jones Product Index (DJCI) Gold preserved its leading perch for this century after reaching an all-time high in December. Gold accomplished a 12.8% return, surpassing both bonds and broad products, with the S&P GSCI taping a -4.3% yearly return. Returning to the start of the century, the DJCI Gold produced a 7.8% yearly return, compared to a 7% return for the S&P 500 throughout that time. Changing for volatility, gold has actually shown much better risk-adjusted returns than stocks, with a Sharpe ratio of 0.48 versus 0.45 for equities. Reserve banks appear to have actually taken notification in the outperformance of gold. After trading flat for much of the year, the

S&P GSCI Gold and S&P GSCI Silver staged a 4th quarter rally, increasing 11.4% and 7.2%, respectively. International reserve banks supported gold need, including over 800 metric heaps to their portfolios with information through October. Gold has actually traditionally supplied financiers an option to fiat currency. Going into the reserve bank purchase information, nations consisting of Russia and China have actually led the boost in reserve bank holdings. Foreign reserve banks appear to progressively value gold’s hedge versus inflation, financial obligation default and dollarization. Product Market Wrap-up

Energy weighed down product efficiency in 2023, with the

S&P GSCI Gas falling 62.6%. The decrease shows a go back to the longer-term cost levels observed throughout the previous years, along with robust production in addition to decreased export need of melted gas. The wider petroleum complex was combined, as lower oil didn’t equate to falling gas rates. The S&P GSCI Energy dropped 5.2% for the year, while the S&P GSCI Unleaded Fuel increased 5.0%. The posts on this blog site are viewpoints, not suggestions. Please read our

Wenli Costs Hao

Senior Lead, Elements and Dividends Indices, Item Management and Advancement

S&P Dow Jones Indices

As the leading dividend index service provider, S&P DJI is continuously searching for brand-new techniques and methods to bring unique concepts to the marketplace. Our just recently released

S&P 500 ®(* )High Dividend Development Index is a prime example of this ingenious thinking, as it integrates a positive evaluation into its approach. This index tracks business in the S&P 500 that have not just provided constant or growing dividends in the past however likewise have the greatest projection dividend yield development. In doing so, constituents are picked based upon what dividend they are anticipated to pay rather of being evaluated entirely on what they have actually paid in the past. In this blog site, we will provide the index approach, present the S&P Global Dividend Forecasting Dataset and examine the index’s risk/performance profile. Approach Summary

To be qualified for choice, constituents should have preserved or grown their historical dividends for 5 successive years and should likewise be predicted to do so over the next 12 months.

From this swimming pool of qualified stocks, the leading 100 constituents with the greatest projection dividend development ratings are picked. Ball game is calculated as the 12-month projection yield minus the 12-month historic yield.

Lastly, the index constituents are weighted by projection dividend yield with restrictions put on private stocks and GICS

®

sectors. 1 To decrease turnover, the index utilizes a 20% buffer. Dividend Forecasting Information The Dividend Projection Dataset is sourced from S&P Global Market Intelligence, which is another department within S&P Global. This group has more than 40 experts carrying out essential analysis with the objective of providing exact projections of the size and timing of dividend payments. They serve over 150 consumers throughout the world, consisting of the majority of the top-tier international banks.

2

Efficiency Evaluation The efficiency data that follow are computed beginning in 2010, when the information for the dividend forecasting dataset started. For this reason, the back-tested information integrates projections that were saved as and when they were made, without any look-ahead predisposition.

While this duration has actually been a strong efficiency duration for the S&P 500, the S&P 500 High Dividend Development Index has more than kept up. Given that 2010, it has actually had actually an annualized return of 11.94% while providing a considerably greater yield.

Drawback Defense and Benefit Involvement

The historic capture ratios versus the S&P 500 reveal that the S&P 500 High Dividend Development Index has actually shown reasonably protective attributes (94.5% drawback capture). Additionally, typically, the index has actually traditionally taken part in 96% of the marketplace return in up-market durations.

3

This is greater than many dividend techniques and is most likely an outcome of its reasonably lower worth tilt and greater development tilt. Historic Yield and Dividend Development Analysis This ingenious approach provides a special mix of dividend development and high yield. Given that 2010, the index has actually had a typical yield of over 3%, easily outshining its standard and other techniques within the dividend development classification.

Remarkably, for a dividend technique using a high yield, the index likewise has actually a high annualized dividend development rate. From 2010 to 2022, the S&P 500 High Dividend Development Index grew its dividend at a yearly rate of 13.8% (see Exhibition 3). This exceeds the long-lasting U.S. inflation rate, even with the current spike in inflation over the last couple of years.

Element Direct Exposure

Exhibition 4 reveals the aspect direct exposure distinction in between the S&P 500 High Dividend Development Index and

S&P 500 High Dividend Index

in regards to Axioma Threat Design Element Z-scores. The S&P 500 High Dividend Development Index showed less worth tilt and had lower dividend yield than the S&P 500 High Dividend Index. Sector Direct Exposure From a sector point of view, the S&P 500 High Dividend Development Index had lower sector weights in Energies (-11.5%) and Realty (-5.8%), while having greater sector weights in Industrials (9.6%) and Infotech (6.3%) than the S&P 500 High Dividend Index (see Exhibition 5).

In a market loaded with passive dividend options, the S&P 500 High Dividend Development Index sticks out by using a positive method while traditionally using high dividend development and high yield. This index’s historic lower worth tilt and greater development tilt might assist to prevent compromising prospective upside when looking for high yield.

1

For more info about the index style, please see the

S&P 500 High Dividend Development Index Approach 2 To learn more, please see this

link 3 The marketplace is specified as the month-to-month efficiency of S&P 500 standards from April 16, 2010, to Oct. 31, 2023.

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

Historic Offer at COP28 to Shift far from All Nonrenewable fuel source

Jason Ye

Director, Elements and Thematics Indices

S&P Dow Jones Indices

Tidy energy has actually definitely been a popular subject in 2023, specifically amongst those at the front and center of conversations at the United Nations Environment Modification Conference (COP28) in Dubai, which simply concluded. As we are approaching completion of 2023, we wished to examine the outcomes of the S&P Global Clean Energy Index Series rebalance from October and share a few of the essential advancements from the 2nd half of the year in the tidy energy area.

October Rebalance

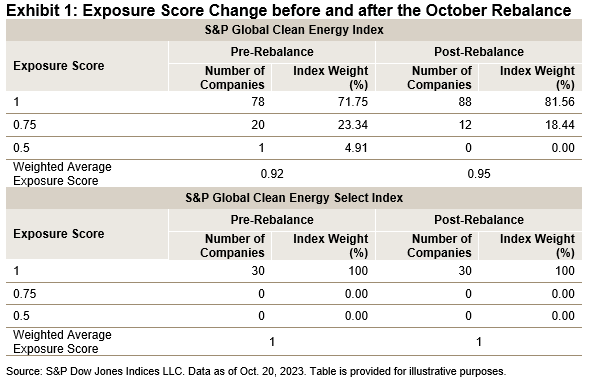

Introduced in 2007, the

S&P Global Clean Energy Index

has actually been a standard to determine tidy energy-related business’ efficiency over the previous 16 years. In April 2021, we likewise released the S&P Global Clean Energy Select Index, which is created to determine the 30 biggest business in international tidy energy services that are noted on industrialized market exchanges. Both the S&P Global Clean Energy Index and the S&P Global Clean Energy Select Index went through a semiannual rebalance on Oct. 20, 2023. In the index approach, we appoint business to 4 containers of direct exposure ratings from 0 to 1 with an increment of 0.25 to determine their pureness of direct exposure to the tidy energy service. Exhibition 1 reveals the modification in direct exposure before and after the October rebalance. We can see that for the S&P Global Clean Energy Index, post rebalancing, we have 10 more business with a direct exposure rating of 1 being contributed to the index. The weighted typical direct exposure rating of the index enhanced from 0.92 to 0.95. This reveals the impact of rebalancing to enhance the pureness of index direct exposure to tidy energy business. The S&P Global Clean Energy Select Index, on the other hand, chooses 30 business with a direct exposure rating of 1 noted in the industrialized market exchanges. On the marketplace allotment breakdown, the significant modification of the S&P Global Clean Energy Index post rebalancing is the 3.11% weight boost in India and 2.72% weight boost in China, together with a 5.01% weight decline in Spain. For the S&P Global Clean Energy Select Index, the weight of the U.S. increased by 11.86%, with a drop of 6.19% in New Zealand and a drop of 5.41% in Brazil.

S&P Global Clean Energy Index Efficiency YTD in 2023

After outshining the

S&P Global BMI

in 2022, both the S&P Global Clean Energy Index and the S&P Global Clean Energy Select Index underperformed YTD through completion of November 2023. The S&P Global Clean Energy Select Index was down 21.49% and the S&P Global Clean Energy Index was down 27.88% in USD overall return terms. There was considerable dispersion seen amongst constituents; a few of the efficiency laggers consisted of Sunpower Corp (-76.98%), SolarEdge Technologies (-71.98%) and Plug Power (-67.34%), while Chubu Electric Power (up 38.24%), VERBUND AG (up 16.54%) and Very First Solar (up 5.33%) offseted a few of the loss with favorable efficiency contributions. Regardless of the efficiency headwind, we continue to see motivating conversations worldwide on the energy shift, consisting of the following picked highlights. Secret Advancement

The International Energy Firm (IEA) Launched the World Energy Outlook 2023

In October, the IEA launched the World Energy Outlook 2023, in which it states that using nonrenewable fuel sources is not decreasing rapidly enough, however the relocate to renewable resource is “unstoppable”.

1

According to the report, “Tripling renewable resource capability, doubling the rate of energy effectiveness enhancements to 4% annually, increase electrification and slashing methane emissions from nonrenewable fuel source operations together offer more than 80% of the emissions decreases required by 2030 to put the energy sector on a path to restrict warming to 1.5 ° C.” 2 International Promise on Renewables and Energy Performance At COP28, the International Promise on Renewables and Energy Performance was signed by 121 nations.

3

To name a few goals, those who sign the promise dedicate to “collaborate to triple the world’s set up renewable resource generation capability to a minimum of 11,000 GW by 2030, considering various beginning points and nationwide scenarios.” 4 POLICE 28 Concluded with an Offer to Shift far from All Nonrenewable fuel source After lots of nights of conversation, practically 200 nations reached an offer to shift far from all nonrenewable fuel sources. This first-ever contract when again imposes the international dedication to net no emissions by 2050. Although the offer is not lawfully binding, the message is loud and clear. It is now on each nation to establish its own program in order to phase out nonrenewable fuel sources “in a simply, organized and fair way.”

5

1 https://www.bbc.com/news/science-environment-67198206

2 IEA (2023 ), World Energy Outlook 2023, IEA, Paris.

https://www.iea.org/reports/world-energy-outlook-2023 3 https://energy.ec.europa.eu/news/cop28-eu-energy-days-focus-implementing-clean-energy-transition-after-launch-global-pledge-2023-12-04_en

4 https://energy.ec.europa.eu/system/files/2023-12/Global_Renewables_and_Energy_Efficiency_Pledge.pdf

The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

Going After Efficiency

Craig Lazzara

Handling Director, Index Financial Investment Technique

S&P Dow Jones Indices

” … in some cases I have actually thought as lots of as

6 difficult things before breakfast

“— The White Queen, Through the Looking Glass

Should a property owner count on historic efficiency information to choose supervisors? The effectiveness of doing so depends upon the responses to 3 concerns: What portion of the supervisor universe is really talented?

How talented are they?

- How fortunate might the “common” supervisors be?

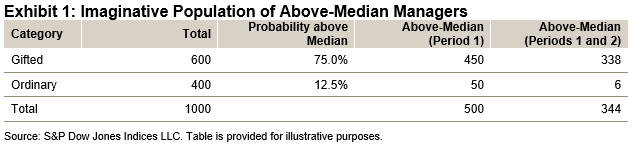

- For instance: Expect we presume that 60% of all supervisors are “talented” and 40% are “common,” that a talented supervisor has a 75% likelihood of attaining above-median outcomes, which a regular supervisor has a 12.5% opportunity of doing the very same. Exhibition 1 reveals some ramifications of these presumptions for a 1000-manager universe.

- Exhibition 1 includes both great and problem for our theoretical possession owner. The bright side is that after one duration, 90% (450/500) of the above-median supervisors are truly talented; if our presumptions are proper, working with just from the above-median swimming pool will raise the chances of success. The problem is that

our presumptions are probably inaccurate,

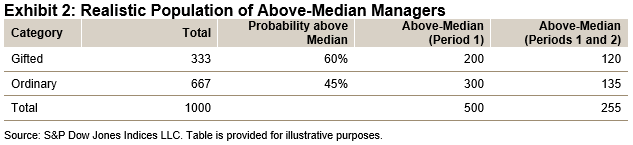

not to state extremely impractical. Why? Due to the fact that these presumptions indicate that 69% (344/500) of duration 1’s above-median supervisors will likewise be above typical in duration 2– a perseverance rate far higher than those we in fact observe Exhibition 1 is, unfortunately, an artifact of wishful thinking. If Exhibition 1’s presumptions are plainly incorrect, what options might be more reasonable? To be more modest, we can decrease the population of talented supervisors from 60% to one-third, decrease their likelihood of ranking above typical from 75% to 60%, and narrow the space in between the talented and the common by setting the common supervisors’ opportunity of being above typical at 45%. As previously, Exhibition 2 includes both great and problem for our theoretical possession owner. The bright side is that utilizing Exhibition 2’s presumptions, 51% (255/500) of duration 1’s above-median supervisors ought to duplicate that efficiency in duration 2. Although we do not frequently see outcomes that great, 51% determination is

not unprecedented

, therefore Exhibition 2 is at least a rather possible design of truth. The problem in Exhibition 2 is that just 40% (200/500) of duration 1’s above-median supervisors are truly talented; 60% of them arrived through luck instead of ability. And maybe even worse news: just 47% (120/255) of the supervisors who are above typical in 2 successive durations

are truly talented. Simply put, a property owner who employs from the above-median swimming pool is most likely to get a regular supervisor than a talented one. Even if we presume that truly talented supervisors exist– which they remain talented with time– working with an above-median entertainer offers a less-than-even opportunity of discovering the talented supervisor we are looking for. Active management is hard, as readers of our SPIVA Scorecards

understand well; recognizing exceptional supervisors is maybe similarly difficult. Depending on historic efficiency rankings is not likely to be valuable. The posts on this blog site are viewpoints, not suggestions. Please read our Disclaimers

Get a Holistic Lens on Sustainability Classifications

ESG

-

Tags

Business Sustainability Evaluation, -

ESG,

ESG information, ESG ratings, effect investing, Indexing ESG, indexing sustainability, S&P Global Corporate Sustainability Evaluation, S&P Global CSA, S&P Global ESG Ratings, S&P Global S1, S&P International Sustainability1, sustainability, sustainability information, sustainability indices Make more educated sustainability choices with much deeper information– our indices are powered by analytics from the world-renowned S&P International Business Sustainability Evaluation. https://www.youtube.com/watch?v=Ny72YT4WXwI

The posts on this blog site are viewpoints, not suggestions. Please read our

Tags Business Sustainability Evaluation,